Pradhan Mantri Jeevan Jyoti Bima Yojana Online Form | PMJJBY Apply Online Registration Form | Apply Online Jeevan Jyoti Bima | PM Jeevan Jyoti Bima Yojana Online Registration & Eligibility To Apply |

Our honourable Prime Minister Shri. Narendra Modi Ji has launched Jeevan Jyoti Bima Yojana on 9 May 2015 with a motive to provide Life Insurance policies to all the poor citizens of the country. The policyholder has to make a nominee in case of his/her death the amount of insurance will be paid to their family members.

Today through this article we will provide you with all types of information about PM Jyoti Jeevan Bima Scheme 2024 like Purpose, Eligibility Criteria, Benefits, Features, Important Documents etc. Apart from this, we will share with you the process of applying online under this scheme. To get complete information about this scheme, read this article till the end.

Pradhan Mantri Jeevan Jyoti Bima Scheme 2024

Central Government has launched PMJJBY in order to provide life insurance policies to all citizens who have an age limit from 18 to 50. By applying under this scheme, they just have to buy the premium by paying an amount of Rs. 330 each year. The policyholder has also to make his or her nominee in case of his death the amount of benefit will be paid by the government to the nominee.

PM Jeevan Jyoti Bima Scheme has been launched by the Prime Minister of India. By applying under this scheme life insurance of Rs. 2,00,000 will be provided to the policyholder family in case he or she dies within holding this scheme. Amount of benefits will be available to the applicant at the age of 50.

Highlights Of PMJJBY 2024

Highlights of this scheme are as follows: –

| Name of the Scheme | Pradhan Mantri Jeevan Jyoti Bima Yojana |

| Known as | PMJJBY |

| Launched by | Prime Minister Shri. Narendra Modi Ji |

| Launching date | 9th May 2015 |

| Launched under | Central Government or Government of India |

| Delegated Ministry | Ministry of Finance, Government of India |

| Administered through | LIC and other Life Insurance Companies |

| Master Policyholder | Participating banks |

| Act and Regulation | Insurance Act and IRDA Regulations |

| Applicable to | Citizens of India |

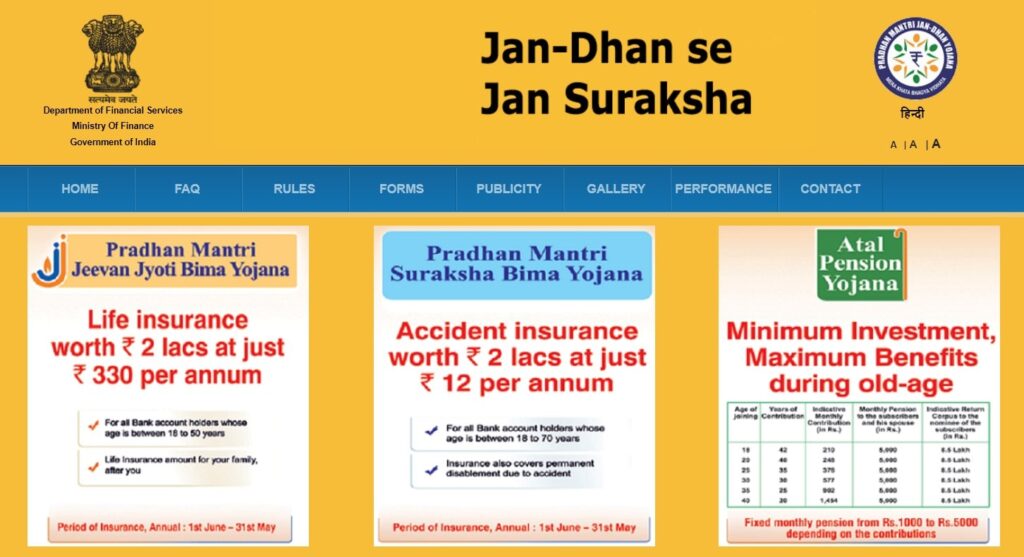

| Special Campaign | Jan Suraksha Yojana Campaign |

| Objective | To provide Life Insurance Policy to the residents of India |

| Benefit | The nominee will get Rs. 2 lakhs on the death of the policyholder |

| Beneficiaries | Citizens of the country |

| Minimum Age limit | 18 years |

| Maximum Age limit | 50 years |

| Maturity age | 55 years |

| Premium Amount | Rs. 330/- |

| Auto-renewal facility | Auto-debit |

| Enrollment Period | 1st June to 31st May |

| Claim Settlement | After 45 days of completion |

| Termination of Assurance | On attaining 55 years of age Closure of bank account |

| Form of benefit | Life Insurance cover of Rs. 2 lakhs |

| Mode of application | Online |

| Scheme Type | Life Insurance Scheme |

| Helpline number | 18001801111 1800110001 |

| Official Website | www.jansuraksha.gov.in |

Objectives of PMJJBY 2024

The foremost objective of launching the Jeevan Jyoti Bima Scheme is to encourage the members of the family to sustain their livelihood if the main income earning person get dies, an amount of 2 lakhs will be given to the family members. With this amount, they can continue their studies without having to depend upon others.

Another main objective of starting PM Jeevan Jyoti Bima Yojana is to provide Social security provisions to the members of the family whose main income-earning members have been died. The minimum age for applicants to apply under this scheme has been fixed for 18 age and the maximum age to purchase this policy is 50 age.

Jan Suraksha Campaign

At Hanumangarh District, a Special Campaign with the name Jan Suraksha Campaign has been inaugurated by the District Collector Shri. Nathmal Didel on 26 October 2021 in order to make awareness about this scheme, so that the citizens can avail the benefit of life insurance by applying online under this scheme.

Premium Amount For Purchasing Policy

To avail of the benefit of this scheme, the applicant will need first to purchase this policy by paying the amount of premium which is Rs. 330. Only those applicants can take policy plans that have an age limit between 18 to 50 years. The applicant must hold a bank account the amount of the premium will automatically be debited from the policyholder account each year.

Charges covered under amount of premium as per follows: –

- Insurance premium to LIC = Rs. 289/-

- Repayment of expenses for BC/Micro/Corporate/Agent = Rs. 30/-

- Repayment of Administration Fee of Participating bank = Rs. 11/-

- Total amount of premium = Rs. 330/- only

Enrolment Period

Delayed enrolment for prospective cover is possible with payment of pro-rata premium as described below: –

- For enrolment in June, July and August – Full Annual Premium of Rs.330/- is payable.

- For enrolment in September, October, and November – pro rata premium of Rs. 258/- is payable

- Enrolment in December, January and February – pro rata premium of Rs. 172/- is payable.

- For enrolment in March, April and May – pro rata premium of Rs. 86/- is payable.

Auto-Renewal Facility

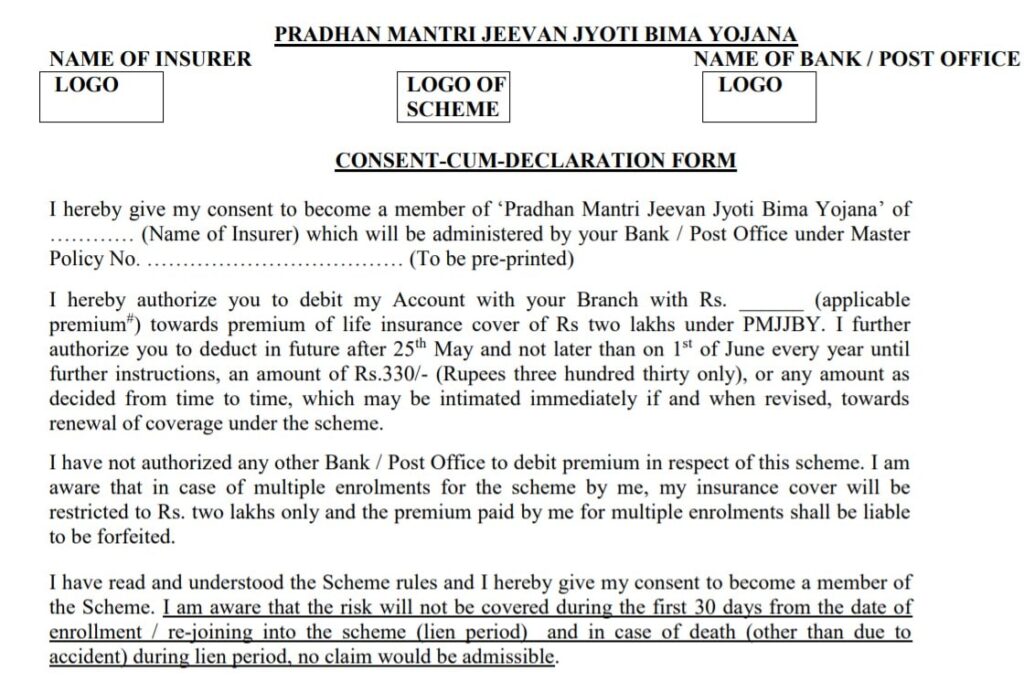

The government has allocated an Auto-Renewal facility for purchasing this policy plan back after its expiration term. The amount of the premium will get deducts every year in the month of May from the bank account of the policyholder so that he/she again get registered under this policy plan. For this, the applicant must ensure that he has a sufficient amount of money in a bank account.

Claim Settlement Within 45 days of Enrollment

Applicants will need first to pay the amount of premium policy, and then he or they will be able to avail the benefit under this scheme. The applicant can claim the insurance amount after the completion of 45 days of enrollment because the insurance company will not settle the claim in the first 45 days so the applicant has to wait first.

Role Of Insurance Company And Bank

This scheme will be sponsored by the LIC or other Life insurance companies which will be operated with the association of participating banks. Banks will be responsible for deducting the amount of premium from the policyholder every year before the due date. After deducting this amount, the bank transfers this amount to the Insurance Company.

Analysis of Claim Received Under PMJJBY

The analysis of claims received in last 5 years as per follows: –

| Year | Claims Received |

| 2016-2017 | 62,166 |

| 2017-2018 | 98,163 |

| 2018-2019 | 1,45,763 |

| 2019-2020 | 1,90,175 |

| 2020-2021 | 2,50,351 |

According to RTI Act, around 2,50,351 no. death claims have been received out of which only 2346 no. of death claims have been approved and other remaining have been rejected in 2020-2021.

Statistics of Claims Distributed under PMJJBY

The analysis of claims received in last 5 years as per follows: –

| Year | Claims Distributed |

| 2016-2017 | 59,188 |

| 2017-2018 | 89,708 |

| 2018-2019 | 1,35,212 |

| 2019-2020 | 1,78,189 |

| 2020-2021 | 2,34,905 |

Claim Settlement Due To Covid-19 Death

Citizens can also claim the amount of life insurance if the applicant’s family member has died due to a COVID-19 infection. But he/she can only make claim if they have already purchased this policy in the year 2020-2021. At the age of 18, the applicant can purchase this policy and this ends at the age of 50 years.

Ineligibility Criteria

The applicant will be considered ineligible for applying under this scheme if he/she possesses the following mentioned criteria: –

- The applicant will not be able to avail the benefit of this scheme, if he or she doesn’t hold any bank account on his/her name or his bank account has been closed.

- In case, the applicant have not keep the sufficient amount of funds which is required to cover the amount of Premium amount every year then he or she will be considered ineligible for applying under this scheme.

- Benefit of this scheme will be expired at the age of 50 years for policy holder.

- Minimum age limit for purchasing premium policy has been set up at 18 years and maximum age limit for purchasing this policy is 50 years.

Benefits of PM Jeevan Jyoti Bima Yojana 2024

The benefits of this scheme are as follows: –

- This scheme has been specially launched for poor background citizens of the country.

- All the applicants from the age limit of 18 to 50 can apply under Pradhan Mantri Jeevan Jyoti Bima Scheme.

- On the death of the policyholder, an amount of Rs. 2,00,000 will be allotted to the nominee by the Government.

- The applicant will need first to buy the insurance policy.

- For purchasing the life insurance policy applicant have to pay Rs. 330/- of the premium amount.

- Government will use mode of Direct Benefit Transfer so there will be no chances of corruption undertaken by the officials.

- The amount of the benefit will be provided to the applicant at the age of 55 years.

- Facility of Auto renewal has been allotted by the government for purchasing this premium plan under PM Jeevan Jyoti Bima Yojana.

- The beneficiary can also pay the amount of premium by submitting his self-declaration of good health in case if he or she not be able to deposit the amount of premium before the 31st May.

- SBI have also announced the public for giving life insurance policy to its customers

- In order to bring awareness about this scheme, Special Campaign has been organized by the Government.

Features of PM Jeevan Jyoti Bima Scheme 2024

The features of this scheme are as follows: –

- Pradhan Mantri Jeevan Jyoti Bima Yojana has been launched by our honorable Prime Minister of India Shri. Narendra Modi ji.

- Launching date of this scheme is 9th May 2015.

- This scheme has been launched under Central Government.

- This scheme is a type of Life Insurance Policy allotted by the Government to its citizens.

- Life Insurance Cover of Rs. 2,00,000 will be provided to the applicant on the death of the main family supporter.

- In order to bring awareness of this scheme, a special campaign with the name Jan Suraksha Campaign has already been organized on 26 October 2021 at Hanumangarh district.

- Jan Suraksha Campaign was inaugurated by the District Collector Hanumangarh.

- Applicant will have to purchase the premium plan of Rs. 330/- for availing the benefit under PM Jeevan Jyoti Scheme.

- Maturity age of premium plan will be 55 year.

- Minimum age for purchasing this policy plan is 18 year and maximum age for purchasing premium plan is 50 year.

- Enrollment period of this plan will be from 1st June to 31st May.

- Amount of the premium will be automatically deducted through the bank account number of the policyholder.

- Government has also provided auto-renewal facility for again registering under this scheme.

- An applicant can claim the insurance amount after the 45 days of the enrollment process.

Eligibility Criteria

The applicants must possess the following mentioned criteria for applying online under this scheme: –

- Applicant must pertain the age limit in between 18 to 50 years for purchasing this premium policy as well for applying under this scheme.

- Applicant has to pay the amount of premium of Rs. 330/- each year.

- Applicant has to keep sufficient amount of funds in his or her bank account at time of deduction of the premium amount at the month of May.

- The applicant must have bank account on his/her name.

Important Documents

Some of the important documents required to apply under PM Jeevan Bima Yojana are as follows:-

- Aadhar Card of the applicant is must.

- Identity Card

- Photocopy of the Bank Account Passbook

- Mobile number for receiving OTPs and future messages

- Applicant’s passport size photograph

Process To Apply Online Under PM Jeevan Jyoti Bima Yojana 2024

The applicants are required to follow mentioned below steps for applying online under this scheme: –

- At first you will need to open the Official Website of this scheme.

- Now you will land on the homepage of this site.

- On the homepage, the applicant will need to download the PMJJBY Application Form.

- After then take the print out of this form.

- Then fill all the essential information in it.

- Now you will have to submit this form bank, where your savings bank account will be get opened.

- Before submitting this form to the bank, you have to make sure that you have already keep the sufficient amounts of funds which are required for the payment of premium policy.

- With this application form, you have also to submit the consent letter as well as the amount of the premium will get auto-deduct from your account number.

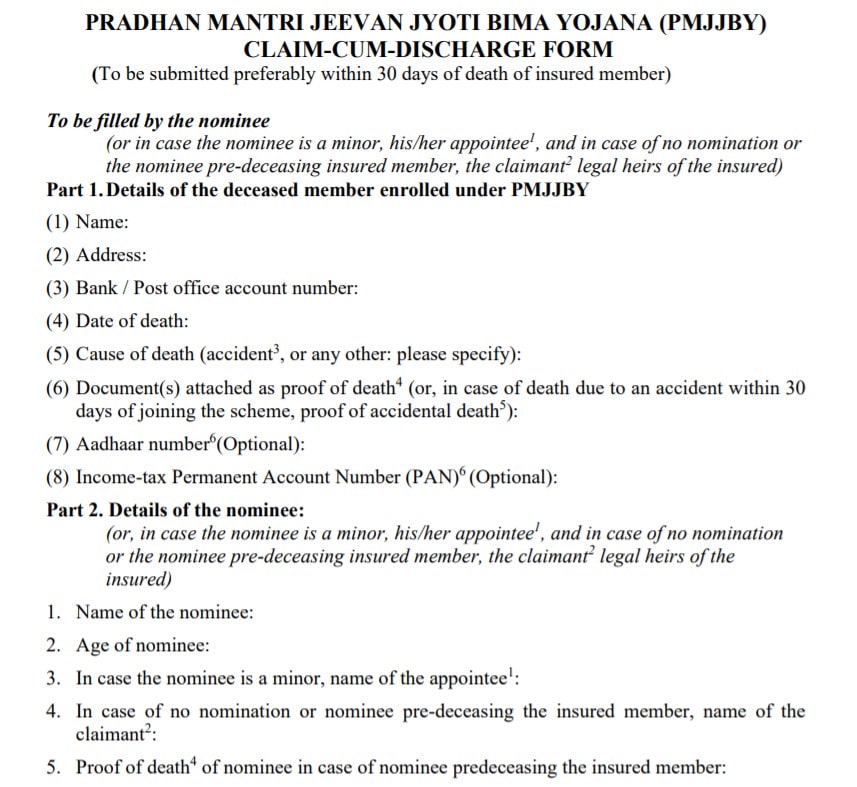

Procedure For Claiming Insurance Amount

The applicants are required to follow mentioned below steps for claiming the insurance amount under this scheme: –

- Before claiming the amount, the nominee of the policyholder will have to first visit the bank for contacting.

- After visiting the bank, the nominee will need to take Pradhan Mantri Jeevan Claim Form and Discharge Receipt Form from the concerned official from the bank.

- Then the nominee will need to fill out each information in the form and have to submit this form.

- Now after that the nominee has to discharge the Receipt Form with the photocopies of Death Certificate and Canceled Cheque.

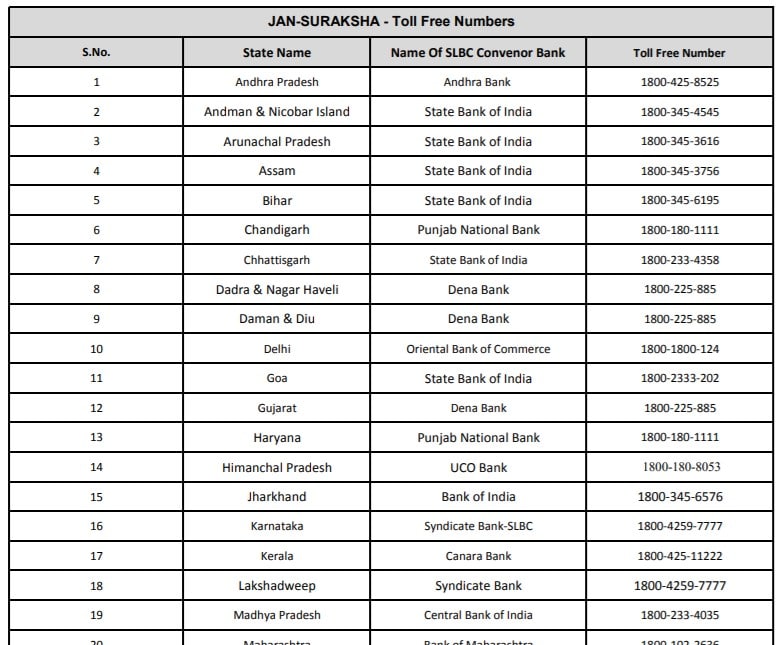

Downloading State Wise Toll Free Number

The applicants will need to follow mentioned below steps for downloading the toll-free numbers under this scheme: –

- At first step the applicant will need to visit and open the official website of this scheme.

- On the homepage, click on the link of Contact.

- Now you will be able to see a new webpage appeared on your screen, where the State Wise Toll Free Number PDF will be shown.

- You can also download this PDF file by clicking on the option of download.

Contact Information

If you have any queries and questions regarding Pradhan Mantri Jeevan Jyoti Bima Yojana, then you can contact this helpline number: – 18001801111/1800110001