PM Mudra Loan Scheme Online Apply 2024 | Eligibility To Apply Under Mudra Loan Scheme & Check Interest Rate | PMMY Online Beneficiary List & Banks List |

PM Mudra Loan Scheme was launched by our honourable Prime Minister of India Shri Narendra Modi Ji on 8 April 2015 in order to provide a loan of Rs. 10, 00, 00 so that the small business ventures will be able to start their own business startup. No processing fee will be charged by the banks for borrowing loans.

Today through this article we will provide you with all types of information about Pradhan Mantri Mudra Loan Scheme 2024 like Purpose, Eligibility Criteria, Benefits, Features, and Important Documents etc. Apart from this, we will share with you the process of applying under this scheme. To get complete information about this scheme, read this article till the end.

PM Mudra Loan Scheme 2024

PM Mudra Loan scheme 2023 have been launched by the Prime Minister of India on 8 April 2015 so that all the business ventures who want to start up their own business ventures can apply under this scheme. The loan has to be repaid by the applicants which have been extended for 5 years. The government has kept no charges for lending loans.

Under PMMY, all kinds of small entrepreneurs such as medium, small and large can avail the benefit of this scheme by having a loan facility that has been provided by the government to all the eligible beneficiaries. Several kinds of banks have been empanelled for lending loans to the beneficiaries such as: – Scheduled Commercial Banks, Regional Rural Banks, Non-Banking institutions, etc.

Highlights Of PM Mudra Loan Scheme 2024

The highlights of this scheme are as follows:-

| Name of the scheme | Pradhan Mantri Mudra Loan Scheme |

| Abbreviated Form | PMMY |

| Launched by | Shri Narendra Modi Ji |

| Objective | To provide loans to all the business startups such as small, medium, large, etc. |

| Launching Date | 8 April 2015 |

| Application Mode | Online Mode |

| Applicant | Citizen of India |

| Lending loan banks | Private Banks Public Banks Regional Rural Banks Commercial Banks |

| Loan Amount | Loan of Rs. Up to Rs. 10,00,000 |

| Repayment tenure | Extended by 5 years |

| Interest rates | Vary from banks to banks |

| Loans categories | Shishu = 50,000 Kishor = 50,000 + Tarun = 5 lakh to 10 lakh or 10 lakh+ |

| Scheme Type | Central Government Scheme |

| Budget of expenditure | Rs. 3 crores |

| Official Website | www.mudra.org.in/ |

| Toll Free number | A toll-free number has been provided under the official website state wise |

Objectives of PMMY 2024

The main objective of launching the Mudra Loan scheme is to provide loans of Rs up to 10 lakhs to all the small business ventures who want to start up their business ventures. An eligible beneficiary can take a loan from any kind of bank which has been empanelled under this scheme. Different financial institutions will charge a different interest rate for repayment of the loan by the applicant.

Another main objective of PM Mudra Loan Yojana is also preventing those business ventures who want to startup for their business but can’t start because of insufficient amount of money which they want to invest for their business venture. A target of covering 3 lakh of people has been set up by the government for providing benefits.

Pradhan Mantri Mudra Loan New Update

Within the launching of PMMY, Government has also provided some provisions for providing loans to beneficiaries for purchasing commercial Vehicles under this scheme. After the addition of this scheme with PM Mudra Loan, all the beneficiaries will be able to take loans for purchasing vehicles such as tractors, auto-rickshaw, taxi trolleys, three-wheeler e-rickshaw, etc. The tenure for repaying the loan has been extended by 5 years.

Types Of Loans Under Mudra Loan Scheme

There are different categories of loans that come under mudra yojana as per follows:-

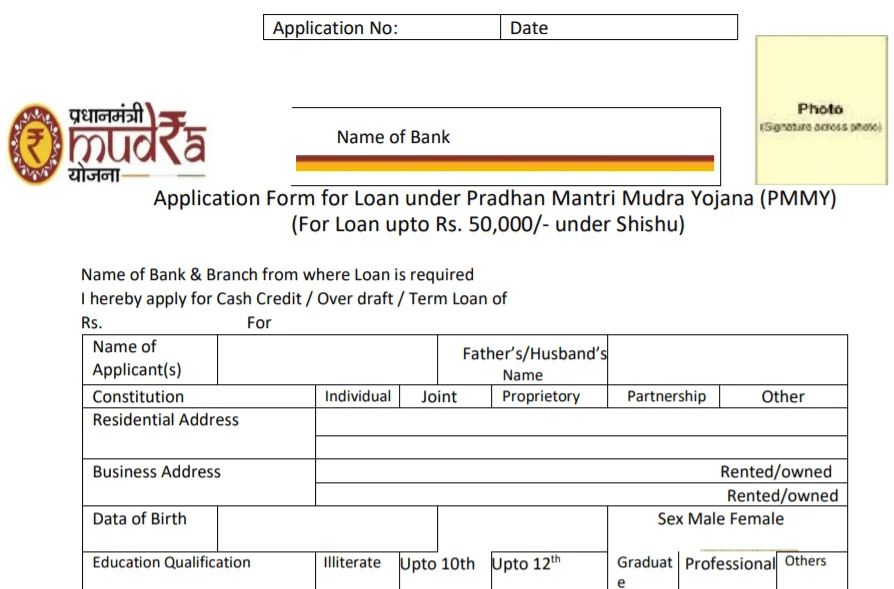

- Shishu Yojana: – This is the first category of mudra loan yojana which will be provided to the applicants. Under this type, loan of Rs. 50,000 will be allotted to applicant.

- Kishor Yojana: – This is the second category of Mudra loan Yojana which will be provided to the applicants. Under this type, loan of Rs. 50,000 /- to 5 lakh/- will be allotted to applicant.

- Tarun Yojana: – This is the third category of Mudra loan Yojana which will be provided to the applicants. Under this type, loan of Rs. 5 lakh/- to Rs. 10 lakh/- will be allotted to applicant.

Assistance Of Mudra Card

As we all know that PM Mudra Loan Yojana will lend loans to all the eligible beneficiaries for making investments in their businesses. But for getting this loan, the applicant must ensure that he or she has Mudra Card. Only after Mudra Card, the applicant will be able to get a loan. The facility of Mudra Card has also been provided under the Mudra loan yojana.

Mudra card is a type of debit card by which the applicants can carry out their payments by withdrawing money ATM machine. The applicants can only be able to get a loan if they have a mudra card otherwise he is ineligible for getting a loan under this scheme. After having a mudra card no one has to face any economical instability. Within this mudra card, the user will be provided with a password in order to facilitate the security of this card.

List Of Beneficiaries

There has been a list of beneficiaries who have been prepared by the government who can apply under this scheme as per follows: –

- Truck owners

- Food business

- Seller

- Micromax factoring

- Sole proprietor

- Partnership

- Micro industry

- Service sector companies

- Repair shop

List Of Co-Operative Banks

There has also a list of cooperative banks made by the government through which the applicants can take loans. Some of them are given below: –

- Baroda Gujarat Gramin Bank RRB

- Rajasthan Kshatriya Gramin Bank RRB

- Baroda Uttar Pradesh Gramin Bank RRB

- Bihar Gramin Bank RRB

- Chaitanya Godavari Grameen Bank RRB

- Deccan Gramin Bank RRB

- RRB Banks list

- Rajkot Citizens cooperative bank

- Kalpur commercial cooperative bank

- Gujarat State Co-o Bank

List Of Empanelled Banks Under PMMY

Some of the banks which have been empanelled under this scheme are as follows:-

- Central Bank of India

- Union Bank of India

- HDFC Bank

- Saraswat Bank

- Axis Bank

- Canara Bank

- Bank of India

- ICICI Bank

- Cooperation Bank

- Jammu & Kashmir Bank

Coverage Of Various Sectors

To expand the benefit of this scheme to all the eligible beneficiaries, various sectors have been covered under this scheme as follows:-

- Land Transport sector activity: – Purchasing of transport vehicles such as autorikshaw, small good transport, 3 wheelers, e-rickshaw, passenger cars, etc.

- Community, social & personal service sector : – providingloans for purchasing saloons, beauty parlors, medicine shops, photocopying machines, boutiques, dry cleaning, cycle and motorcycle, etc.

- Food product sector: – loans will be provided for various food purpose activities such as: – papad making, achaar making, jam or jelly making, cold storages, ice making units, bread and bun making, etc.

- Textile Products sector/activity: – Loans will be provided for under various textile activities such as: – handloom, powerloom, chikan work, embroidery and hand work, traditional dyeing, cotton ginning, furnishing accessories, vehicle accessories, etc.

Measures For The Implementation Of PMMY Scheme

The following measures have been taken for ensuring the implementation of this scheme:-

- Facilitation for the submission of loan applications.

- Udyami Mitra Portal will be used for the provision of online application.

- Organizing campaign in order to bring awareness about this scheme.

- Avoiding of including too much columns in the application forms.

- MUDRA Nodal officer will be hired at Public Sector Banks.

Assistance Of Helpline Number

Many helpline numbers have been provided to all states. Some of them are given below:-

| State | Helpline Number |

| Chandigarh | 18001804383 |

| Punjab | 18001802222 |

| Uttrakhand | 18001804167 |

| Tamilnadu | 18004251646 |

| West Bengal | 18003453344 |

| Rajasthan | 18001806546 |

| Madhya Pradesh | 18002334035 |

| Kerala | 180042511222 |

Benefits of PM Mudra Loan Scheme 2024

The benefits of this scheme are as follows:-

- Pradhan Mantri Mudra Loan scheme enables every person for starting their own business ventures.

- An applicant can get loan up to Rs 10, 00,000 for their startup.

- An applicant can take loan from any bank which has been empanelled for the implementation of PMMY.

- It will provide loans to the applicants at the low interest rate.

- By having the loan facility, no business venture has to suffer from financial instability.

- One of the main benefits of applying under this scheme is that, it will put emphasis for reduction of employment rate and increases the employment opportunities for unemployed peoples.

- The applicants are exempted from paying processing charge for taking loan.

- The applicant can repay the loan which has been extended for 5 years.

- For applying under this scheme, the applicant must have mudra card, because the applicant can only take benefit of this scheme only by having this mudra card.

- With this mudra card provided to the applicants, the applicants can easily fulfill their business needs.

Features of PMMY 2024

The features of this scheme are as follows:-

- Mudra loan Yojana has been launched by the Prime Minister on 8th April 2015.

- At lower interest rates, the loans wills be provided to all the eligible beneficiaries.

- Mudra cards will also be provided to the applicant. Just having this mudra card, beneficiaries will be capable for lending loans from any bank.

- With this loan provided by the government, all business ventures will be able to startup for their business.

- PM Mudra Loan Scheme will work upon for the reduction of unemployment rate and enlargement of employment and entrepreneurship opportunities.

- Different kinds of government and private banks have been empanelled under the supervision of this scheme.

- Those applicants who will apply under this scheme will be able to get loan of Rs up to 10, 00,000.

- The government has stressed out that there should be no processing fee should be charged by the government for lending loans to the applicants.

- The government has also extended the duration of repayment if loan for the 5 years. Beneficiaries can repay their loan for 5 years.

- Under the PM mudra loan yojana, there are 3 types loans have been served:-

- Shishu = Loan amount of Rs. 50,000/-

- Kishor = Loan amount of Rs up to. 50,000/-

- Tarun = Loan amount of Rs. 5 lakh/- to 10 lakh/-

Eligibility Criteria

The eligibility criteria for applying under this PMMY 2023 are as follows:-

- Applicant age must be above the 18 years of old.

- He or she must not be a defaulter of any bank.

- Only those applicants can apply under this scheme who wants to start their own businesses.

Important Documents

Some of the important documents required to apply under the PM Mudra Loan Yojana are given below:-

- Aadhar card

- Pan Card

- Proof of business establishment

- Balance sheet of last 3 years

- Income tax return or sales tax return

- Passport size photograph

- Permanent Residence certificate

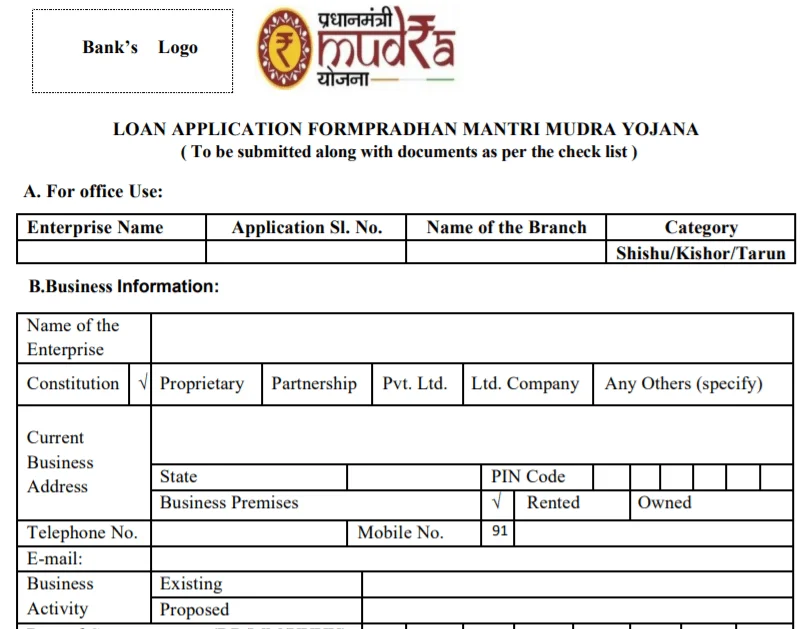

Procedure For Making Online Registration Under PMMY 2024

The applicants have to follow mentioned below steps for making registration under this scheme:-

- First of all the applicant s have to open the official website of this scheme.

- After opening of this official website, you will see home page in front of your computer screen.

- Various types of options mudra loan registration forms will be appeared on the homepage, but the applicant have to click on the option of that form for which he want to apply. The categories of registration forms as per given below:-

- Download registration form for baby

- After clicking on the desired option, a new page will be opened in front of your computer screen.

- At this new page, you can download the registration form for filling.

- Direct link will be provided on your computer screen for the easiness of the downloading for the user.

- Only after the downloading of the registration form, the applicant has to fill all the required details in the asked columns in the form.

- Then after making all the details into the form, the applicant needs to attest all the relevant documents with it.

- Then after that the user needs to submit this registration form by visiting nearest bank.

- After the submission of this registration form in the bank, your form will get verified.

- After the verification process carried out by the bank, the applicant will get the loan within 1 month.

Procedure For Making Offline Registration

The applicants have to follow mentioned below steps for making offline registration under this PMMY:-

- For making your offline registration, the applicant needs to visit his or her nearest cooperative bank, or any kind of private bank/commercial banks.

- After visiting the bank, the applicant has to get Prime Minister’s Mudra Yojana application form from the bank agent.

- The applicant will need to enter all the required details into the asked columns.

- After making all the entries, they have to attach their important documents with this form.

- Within the 1 month of verification process, the applicant will get the loan provided by the bank.

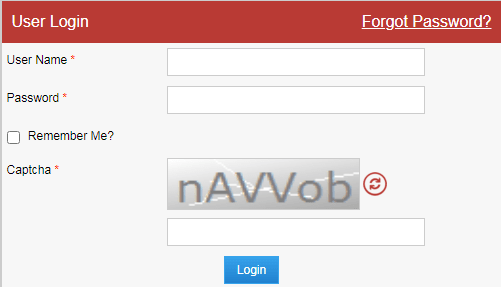

Step By Step Login Procedure

The applicants have to follow mentioned below steps for login under the PM Mudra Loan scheme:-

- Fir making login under their portal, the visitor first needs to visit and open the official website of this scheme.

- After that the homepage will be opened in front of you on your computer screen.

- On the homepage click on the option of Login.

- By clicking on this option, a new page will be appeared where the user needs to enter all his or her details such as: –

- Username

- Password

- Captcha code

- After making all the entries in the required columns, the applicant needs to click on the option of login button.

- After that you will get successfully login under their website.

Procedure For Viewing Annual Reports

The applicants have to follow mentioned below steps for login under PMMY:-

- At firstly the applicant has to visit their official website. Now homepage will opened in front of you.

- Click on the option of Financials at the homepage.

- Then after that the applicant will need to click on the Annual Reports option.

- After clicking on that options, there will be year wise list of all the annual reports will be displayed on your computer screen as per follows: –

- Annual Report 2019-20

- Annual Report 2018-19

- Report 2017-18

- Annual Report 2016-17

- Annual Report 2015-16

- The user has to click on report of the year of which he wants to download. Means he or she can download any annual report of any year as per his requirement.

- After clicking on the desired options, the PDF form of annual report will get downloaded on your device.

- Now you can view the annual report.

Procedure For Viewing Public Disclosure

The applicants have to follow mentioned below steps for viewing Public disclosure under PMMY:-

- At firstly the user will need to open up the official website of this scheme for viewing public disclosure.

- Then homepage will be opened in front of you, at the homepage you will see various options but the user have to click on the option of financials.

- After that click on the option of public disclosure.

- Then a new option you have to select that is financial year. Of which financial year of public disclosure, the user wants to view.

- Then after selecting the financial year, click on the quarter and then select the quarter.

- After thr selection of quarter, a pdf file of the quarter will be opened in front of you.

- At this pdf form file, you can view the details of public disclosure.

Procedure For Getting Tender Information

The applicants have to follow mentioned below steps for getting information related to tender under the Mudra Loan scheme:-

- At first open the official website of this scheme. Then after that homepage will be opened in front of you.

- At the homepage click on the option of tenders.

- After clicking on the Tenders option, user will be able to see a new page opened in front of his screen.

- At this new page, the list of tenders will be shown.

- The user will need to click on that option which he wants to get as per his desire.

- Then after clicking on thr desired option, the significant information will be appeared on your computer screen.

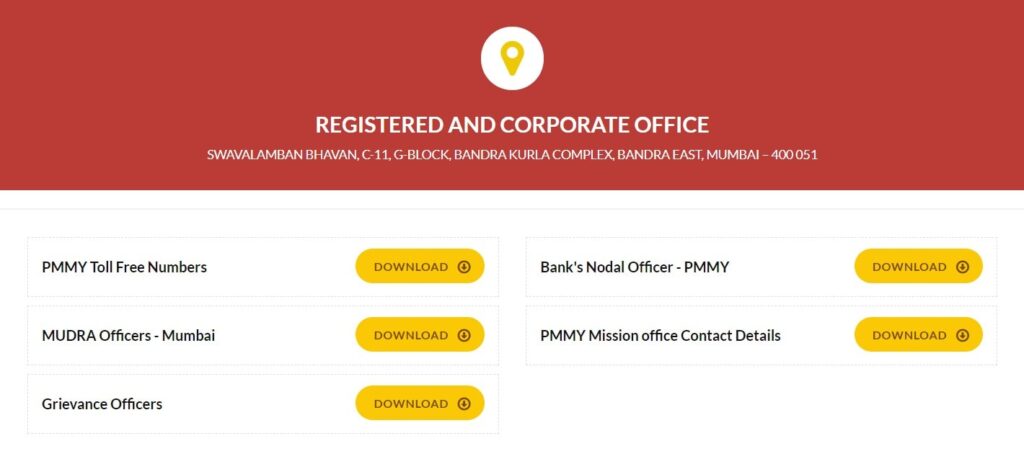

Procedure For Viewing Contact Details

The applicants have to follow mentioned below steps for viewing contact details under PMMY:–

- For viewing contact details, the user will need to open up the official website.

- At the homepage you will see the option of contact us. The applicant will need to click on the option of contact us.

- After that a new page will be opened where there will be many kinds of contact details will be shown as per follows:-

- PMMY Toll Free Number

- Mujra Officers Mumbai

- Grievance Officer

- bank nodal officer

- mission office contact details

- Click on that option which you want to see and then click on the download option for viewing the contact details.

- After clicking on the download option, the relevant contact details will be shown on your computer screen.

Procedure For Viewing Report

The applicants have to follow mentioned below steps for viewing the report under the Mudra Loan scheme:-

- At first the user will need to open the official website of this scheme.

- Then the homepage will opened of this site. At the homepage, click on the option of report.

- After clicking on the option of report, a new page will be opened jn front of you.

- At this new page, the applicant will need to select the user state in which he or she resides.

- Then the relevant information will be displayed on your computer screen.