Atal Pension Yojana 2024 Apply Online | Benefits & Eligibility To Apply Under Atal Pension Yojana | Online Calculator & Form Under Atal Pension Yojana All Details |

Our honorary Prime Minister Shri. Narendra Modi Ji has launched Atal Pension Scheme on 1st June 2015 with a motive to provide pensions to old age persons who possess the age of 60 years. For availing the amount of pension under this scheme, they will need first to invest some sort of money in their premium account.

Through this article you will get all the information regarding the Atal Pension Yojana 2024 such as Objectives, Eligibility criteria, benefits, features and important documents, etc. besides that, we will bring up to date you with the step-by-step application procedures for applying online under this scheme.

Atal Pension Yojana 2024

PM Atal Pension Scheme has been launched under the Central Government of India. The Prime Minister of India has started this initiative. Financial assistance of Rs. 1000 to Rs. 5000 will be provided to those applicants after 60 years of age. But at first, they will need to deposit some amount of money every month which will be basic criteria for the amount of pension scheme.

Shri. Narendra Modi Ji has launched Atal Pension Yojana for all the citizens of the country who have 60 years of age. This scheme is based on the pension plan. Pension of Rs. 1000 to 5000 will be provided to each eligible applicant. Claim settlement can also be done after the death of the main beneficiary who has enrolled under this scheme.

Highlights of Atal Pension Scheme 2024

Highlights of this scheme are as follows:-

| Name of the Scheme | Atal Pension Yojana |

| Launched by | Prime Minister Shri. Narendra Modi Ji |

| Launched under | Central Government or Government of India |

| Launching date | 1st June 2015 |

| Applicable to | Citizens of India |

| Supervision Authority | Pension Fund Regulatory and Development Authority |

| Article Category | Pension Scheme |

| Beneficiary | Workers of unorganized sector |

| Age limit | 18 to 60 years of age |

| Objective | To provide pension to workers of unorganized sectors |

| Benefit | Citizens will get financial assistance for their livelihood |

| Form of Benefit | Pension of Rs. 1000 to Rs. 5000 |

| Minimum Investment | Rs. 210 |

| Maximum Investment | Rs. 1454 |

| Penalty on non-paying the amount | Vary from monthly investment |

| Age of account opening | 18 years |

| Maturity of account | 60 years |

| Premature closure | On the event of death of the applicant |

| Period of investment | 22 years |

| Mode of transfer | Direct Benefit Transfer |

| Age for withdrawal | 60 years |

| Mobile Application | UMANG App |

| Act and regulation | Section 80C , Income Tax Act 1961 |

| Mode of application | Online/offline |

| Address | NSDL e-Governance Infrastructure Limited 1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013 |

| Telephone number | 022 2499 3499 |

| Fax Number | 022 2495 2495 2499 4974 |

| Official website | www.npscra.nsdl.co.in |

Objectives of Atal Pension Scheme 2024

One of the foremost objective of launching Atal Pension Yojana is to provide financial assistance to the persons who are working under unorganized sectors of their occupation field. This scheme will put emphasis on providing social security provisions to citizens of 18 to 60 years of age. This is the crucial age when the person needs some financial assistance.

Another objective of launching the Atal Pension Scheme is to provide a pension amount of Rs. 1000 to 5000 to the citizens of 18-60 years of age. This scheme also serves as a life insurance policy, if the main beneficiary gets die due to any reason then the amount of money will be provided to the nominee on behalf of the dead person.

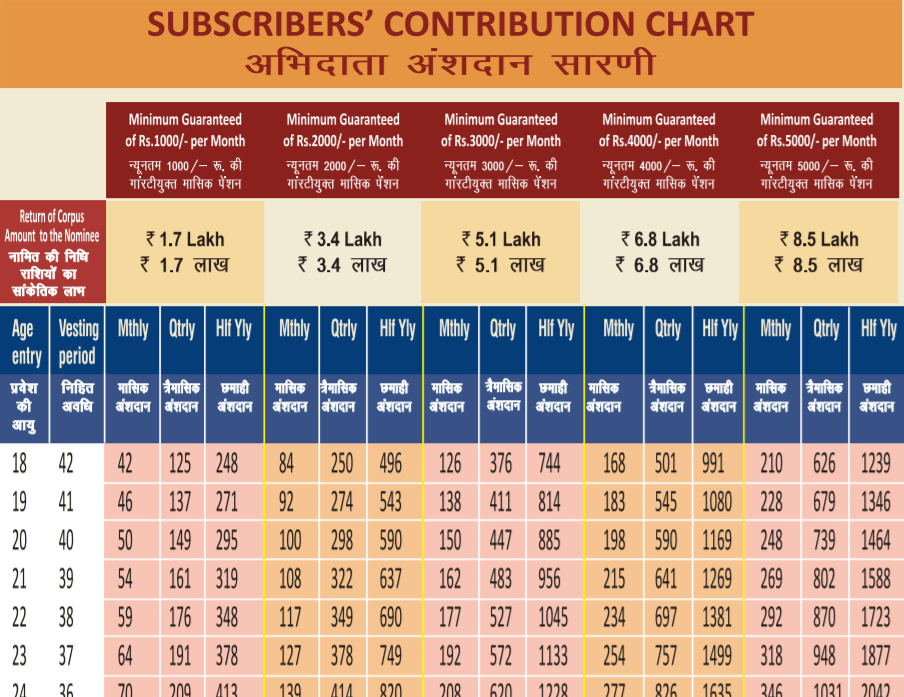

Amount Of Pension

By applying under this scheme, the applicant will be able to get a pension amount of Rs. 1000 to Rs. 5000. Pension will be provided to those applicants who have purchased the premium policy of this scheme. The premium policy can be purchased by any applicant possessing the age between 18 to 40 years of age, but the pension will be received after 60 years of age.

Premium Amount

For availing of the benefit of pension, the applicant will need first to pay the amount of premium under this scheme. This form of investment will vary from age to age. Those applicants who fall under the age of 18 years, will need to pay Rs. 210 and those applicants who possess 40 years of age will have to pay Rs. 297 to Rs. 1454 every month.

Supervision Authority

Atal Pension Scheme is implemented under the supervision and guidance of the Pension Fund Regulatory and Development Authority. This supervision authority will be held responsible for the proper coordination of the maintenance of the distribution of funds allocated for the beneficiaries of this pension scheme.

About 65 Lakhs Of Applicants Got Benefit

As this scheme has been specially launched for providing pensions to the workers of unorganized sector. It has been received, that around 65 lakhs of applicants have been able to get benefit under this scheme. Out of 65 lakhs, 56% of this are men and 44% of this are women. Rs. 20000 Crores of budget have been sanctioned by the Government.

Claim Settlement

In order to provide social security to the family members of the applicant, claim settlement has also been included. The claim can be made by the Spouse of the applicant in case the applicant has died. The nominee will get the whole amount of pension in such a case. Nominee can also claim the money in case both husband and wife have died.

Withdrawal Status

Applicant can withdraw his/her amount of pension after the completion of 60 years of age. Only after attaining the age of 60 years, the applicant will be considered eligible for withdrawing the amount of pension. But before 60 years of age, the beneficiary will not be able to withdraw the amount.

Income Tax Payer Will Be Eligible

As we all know that this scheme has been specially launched for securing the interests of employees of unorganized sectors, but now the government has also extended the benefits of this scheme to the persons who are paying tax means income tax payer person will also be considered eligible for applying under this scheme.

Bank Account Is Must

It is mandatory for the applicant to have a savings bank account or a post office savings account opened because the amount of pension will be directly transferred to their bank accounts so a bank account is a must. Before applying under this scheme, they must have to go through the Aadhar Authentication process carried out by the concerned officials.

UMANG App

Beneficiaries who have enrolled and registered under this scheme can also check their transaction details by visiting and opening the UMANG App. For checking their transaction status, they will need first to login into their account by entering their profile credentials such as name, account and date of birth. Apart from this, applicants can also visit the official website of this scheme.

Grievance Redressal

In order to facilitate the functioning of Grievance Redressal, Government has hired an ombudsman in which the applicants can file their complaint regarding the issues of the registration process or regarding this scheme. Applicant can only submit their grievance in case their query has not been resolved within 30 days from the registration process.

Pension of Rs. 60,000 On Saving Rs. 7/-

It will be very surprising for you to know that you will get a pension amount of Rs. 60,000 by saving Rs. 7/- each day. For availing the benefit of this pension amount, the applicant can start saving and investing Rs. 210/- from the age of 18 years. The beneficiary will be exempted from paying tax under Section 80, Income Tax Act.

SMS Alerts

All the alerts regarding account balance and transaction status will be provided to the account holder through SMS alerts. Applicants can change their personal details through SMS. You will also be able to get information regarding the remaining account balance, and auto-debit of your account through SMS services on your mobile number which you have registered under this scheme.

Payment Process

After purchasing the premium policy under this scheme, you will need to pay every month the amount of premium. The amount of the premium will get auto-debit from your account. Every month, money will be deducted. For this, the applicant has to ensure that he/she has a sufficient amount of balance remaining in his/her account which is required to cover the amount of premium.

Penalty On Non-Paying

Bank authorities will charge a penalty in case you are not able to deposit the amount of premium at a time. Non-paying of premium account will automatically deactivate your account and you will get expelled from taking benefit of this scheme. But you can again regain the benefit by paying penalty charges as per follows: –

| Form of contribution per month | Penalty Charges |

| Rs. 100 | Rs. 1 |

| Rs. 101 to Rs. 500 | Rs. 2 |

| Rs. 501 to Rs. 1000 | Rs. 5 |

| Above Rs. 1001 | Rs. 10 |

Ineligible Beneficiaries

Following applicants will be considered ineligible for applying under this scheme: –

- Employees of Coal Provident Fund

- Employee of EPFO.

- Employees of Simmons Provident Fund

- Employees of Jammu and Kashmir Employees Provident Fund

Benefits Of Atal Pension Yojana 2024

The benefits of this scheme are as follows: –

- One of the main benefit of applying under this scheme is that it will serves as a social security provision after the retirement of main source of job.

- Employees of Unorganized sector will be given main priority for applying.

- Financial assistance of Rs. 1000 to Rs. 5000 will be provided to each eligible applicant.

- For availing the benefit of Atal Pension Scheme, investment per month is mandatory.

- Amount of pension will be given after the completion of 60 years of age.

- Applicant will need to pay amount of premium every month.

- Form of investment which has to be paid by the applicant will be vary from age to age.

- Amount of premium will be range from Rs. 210 to Rs. 1454.

- UMANG App can be used by the applicant for viewing transaction details.

- Bank account can also be reactivated after paying the amount of premium along with the penalty charges.

- Amount of pension can be withdrawn by the nominee in case the applicant has been died under Atal Pension Yojana.

- Facilitation of SMS Alert Services is there to notify you.

Features of Atal Pension Scheme 2024

The features of this scheme are as follows: –

- Atal Pension Yojana has been launched under the Government of India.

- Prime Minister Shri. Narendra Modi Ji has started this initiative.

- Launching date of this scheme is 1st June 2015.

- This scheme is based on Pension Scheme.

- This scheme will implement under the supervision of Pension Fund Regulatory and Development Authority.

- Amount of pension will be from Rs. 1000 to Rs. 5000.

- Purchasing the premium policy is must for availing the benefit of pension.

- Applicant must possess the age in between 18 to 40 years for purchasing premium policy.

- Period of investment will be 20 to 22 years from the period of initial investment.

- Income Tax Payer employees will also be considered eligible but at the same time EPFO employees will be expelled from taking benefit of this scheme.

- Penalty will be charged in case the applicant has not deposited the amount of premium at a time.

- Maturity amount of the pension will be provided after the completion of 60 years of age under Atal Pension Scheme.

Eligibility Criteria

The applicants must possess the following mentioned criteria for applying online under this scheme: –

- The applicant must be a citizen of India.

- Applicant must possess the age in between 18 to 40 years for purchasing premium policy as well for applying under this scheme.

- Applicant has to keep sufficient amount of funds in his or her bank account at time of deduction of the premium amount each month.

- The applicant must have bank account on his/her name either savings bank account or post office savings bank account.

Important Documents

Some of the important documents required to apply under this scheme are as follows: –

- Aadhar card of the applicant is must

- Identity Card

- Proof of Permanent address

- Applicant’s passport size photograph

- Mobile number in case for receiving OTPs and future messages

Process To Open Account Under Atal Pension Scheme 2024

The applicants are required to follow mentioned below steps for applying under this scheme: –

- For opening bank account, you will require first to visit the bank where your savings account has been opened.

- Then get the registration form of PM Atal Pension Scheme from them.

- After getting form, fill this form correctly.

- Now you will have to attach all the relevant documents with it.

- In this way, you will be able to open your account under this scheme.

Downloading Contribution Atal Pension Chart

The applicants are required to follow mentioned below steps for downloading the Contribution Chart under this scheme: –

- To download contribution chart, you will need first to open the Official Website of this scheme.

- Now you will be able to see the homepage of this site.

- On the homepage, click on the link of APY-Contribution Chart.

- After that you will be able to see the contribution chart on your screen.

- Now you can view this chart as per your convenience.

- You can also make it available on your device by downloading.

Procedure To View Enrollment Details

The applicants are required to follow mentioned below steps for viewing enrollment details under this scheme: –

- To view endowment details, visit and open the official website of this scheme.

- On the homepage, click on the option of Enrollment Details.

- Now a new page will be get opened on your screen.

- Here you will get following options displayed along with the pictorial representation: –

- Gender Wise Enrollment

- Age Wise Enrollment

- State/UT Voice Enrollment

- Bank Voice Enrollment

- You can click on any one option as per your choice of requirement.

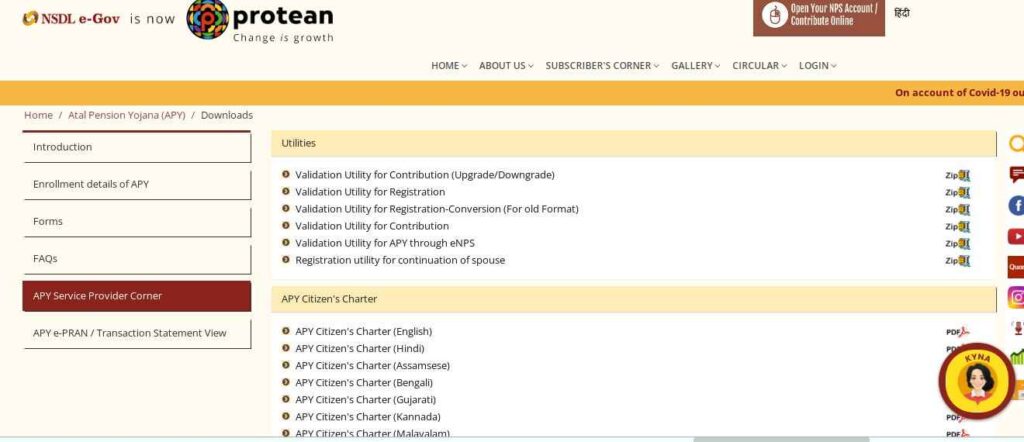

Process To View Information Related To Service Provider

The applicants are required to follow mentioned below steps for viewing service provider under this scheme: –

- To view Service Provider, visit the official website of Atal Pension Scheme.

- Now you will land on the homepage of this site.

- On the homepage, click on APY Service Provider Corner.

- Then a new page will be get appeared on your screen.

- On this new page, you will be able to see the PDFs file formats of many files.

- You can view any one of them by clicking on it.

- If you want download this file then click on the download button.

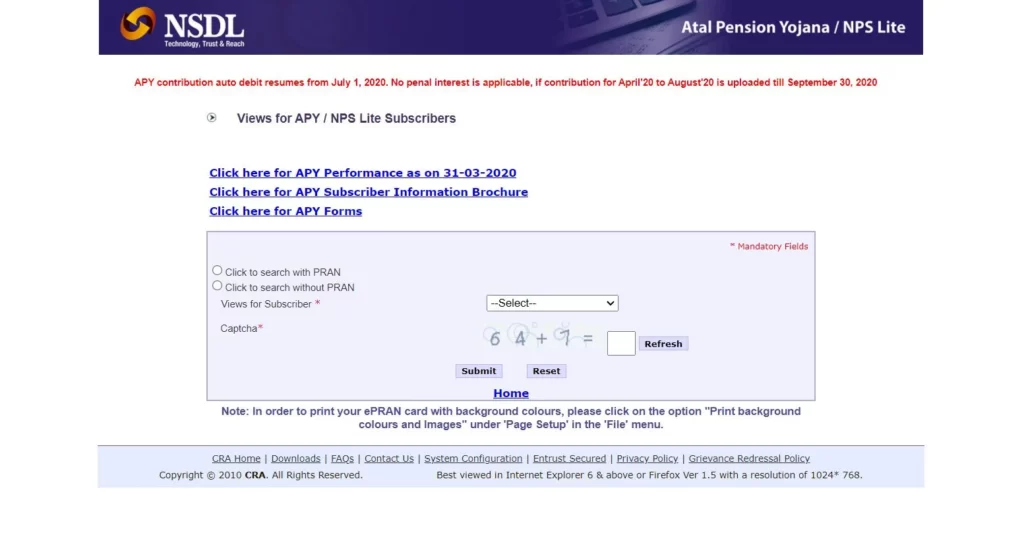

Viewing e-PRAN/Transaction Statement Details

The applicants are required to follow mentioned below steps for viewing e-PRAN/Transaction statement details under this scheme: –

- To view transaction statement, you will need to visit and open the official website of this scheme.

- On the homepage, click on the option of APY e-PRAN/ Transaction Statement View.

- After clicking on this option, you will be redirected to a new page.

- Here you will be shown with 2 options: –

- Click to search with PRAN

- Click to search without PRAN

- Enter your details from any one option mentioned above.

- Now select the option in front of the column of view for subscriber.

- Then you will have to enter the Captcha Code shown on your screen.

- At last, click on the submit button.

- In this way, you will be able to see the Transaction Statement Details.

Contact Information

If you have any queries and questions regarding PM Atal Pension Yojana, then you can contact this mentioned below telephone numbers and email IDs: –

Escalation Level For Complaints/ Queries

| Officer name | Role | Telephone Number | Email Id |

| Mr. Chandrashekhar Warange | Grievance Redressal Officer (GRO) | 022 24993499 | [email protected] |

| Mr Mandar Karlekar | Chief Grievance Redressal Officer (CGRO) | Fax no: – 022 24952594 | [email protected] |

Escalation Level For Exits Related To NPS

| Officer name | Telephone Number | Email Id |

| Ms Manjiri S. Salvi | 022 24994274 | [email protected] |

| Mr Dinesh Dalvi | [email protected] | |

| Mr Mandar Karlekar | Fax no: – 022 24994974 | [email protected] |

Branches

| State | Address | Telephone | Fax |

| Kolkata | 5th Floor, The Millennium, Flat No. 5W, 235/2A, Acharya Jagdish Chandra Bose Road, Kolkata – 700 020 | (033) 2281 4661 / 2290 1396 | (033) 2289 1945 |

| Chennai | 6A, 6th Floor, Kences Towers, #1 Ramkrishna Street, North Usman Road, T. Nagar, Chennai – 600 017 | (044) 2814 3917/18 | (044) 2814 4593 |

| New Delhi | 409/410, Ashoka Estate Building, 4th Floor, Barakamba Road, Connaught Place, New Delhi – 110 001 | (011) 23705418/ 2335 3817 | (011) 2335 3756 |

| Ahemdabad | Unit No. 407, 4th Floor, 3rd Eye One Commercial Complex Co-op. soc. Ltd., Above Vijay Sales Stores C.G. Road, Near Panchvati Circle, Ahmedabad – 380 006 | (079) 2646 1376 | (079) 2646 1375 |